19 Frugal Ideas To Save Money

Frugality was once a virtue. Back in the day, being able to stretch a dollar was something to be proud of. Living within your means was a necessity as there was no such thing as credit cards or payday loans. If you’re wondering how to instill a sense of thriftiness to your budget, here’s a roundup of frugal ideas to save money.

The first “charge card” was first issued in 1951 by Franklin’s National Bank. In 1958, BankAmericard introduced the first revolving credit program by sending out 60,000 credit cards to Californians. In 1959, American Express created its first plastic credit card. And the concept of modern debt is born.

What did people do before credit cards?

Well, they saved. They lived within their means. They saved up for big purchases and paid upfront with cold, hard cash. They were frugal because they had no other choice.

Frugality (noun): the quality of being careful when using money or food.

—Cambridge Dictionary

Ways To Trim Down Your Water Bill

Is your monthly water bill out of control? Here’s a roundup of 30 practical ways to save on your water bill.

What is frugal behavior?

Simply put, frugal behavior is spending with intention. It’s a thoughtful approach to spending money versus spending mindlessly and with reckless abandon.

The great thing about being frugal is you get to decide what’s important to you. Spend money on the things that matter to you, but cut back on other expenses.

Being frugal doesn’t have to be painful.

Everyone has a few non-negotiables. For some, Friday night pizza is a non-negotiable, but that morning Starbucks could be sacrificed.

For others, travelling sparks joy. But you can still see the world on a budget. Budget travelling has become much more popular with the rise of affordable vacation rentals like Airbnb.

How To Save Money on Toilet Paper

We’re all stocking up on toilet paper these days. Here’s how to spend less of your hard-earned cash on TP.

Frugality should not be confused with stinginess, or being cheap. A stingy person is not willing to spend money on anyone, even when necessary (think Scrooge). A frugal person is willing to spend money carefully by ensuring it doesn’t go to waste.

Here are some basic frugal behaviors to practice:

- Avoid frivolous purchases.

- Spend only what you can pay off at the end of every month.

- Stick to your budget.

- Save up for big purchases instead of putting it on credit.

- Waste not, want not—don’t waste money or resources (food, clothes, etc.). Heck, even wasting toilet paper adds up.

Can you get rich by being frugal? Probably not. However you can develop good spending habits and save money by practicing frugality. This helps you grow wealth over time.

“A dash of frugality is a good thing for everyone.”

—Jason Chaffetz

Clever Ways To Save on Your Natural Gas Bill

You don’t need to freeze to save money on your natural gas bill. Here’s a few smart ways to reduce your monthly gas bill.

Benefits of frugality

To me, there’s so much more to frugality than just saving money. Frugality is a mindset, a way of simpler living.

In an age where we’re bombarded with ads for the latest iphone or gadget, we’re not ever really satisfied with what we have. We always want more and more.

A side benefit of frugality is learning to accept and appreciate the things you already have without constantly yearning for more.

We also learn to do things for ourselves. While we outsource many tasks, we can save money by learning to do simple repairs around the house. Our grandparents could do basic plumbing repairs, sew, and grow their own food. How many of us can still say the same?

By not focusing on materialism, we can take pleasure in the simple things in life.

frugality = freedom

20 Ways To Save Money on Laundry

If you do lots of laundry every week, it can quickly add up. Here’s a roundup of tips and tricks to save money on laundry.

Making a monthly budget

If you’re really serious about cutting down your expenses, the best place to begin is to make a monthly budget. And sticking to it.

The Balance outlines six steps to developing a monthly budget:

- Gather and review monthly statements: This include banking statements, utility bills, and receipts from the past 3 months. This gives you an idea of your spending habits.

- Calculate income: Figure out how much money you regularly bring in each month from your employment as well as other sources of income such as child support, government benefits, etc.

- Determine monthly expenses: Calculate roughly how much you spend each month. This includes housing, groceries, utilities, cable/internet, recreation, education, child care, and entertainment.

- Calculate fixed vs. variable expenses: Fixed expenses remain the same each month while variable ones fluctuate. Examples of a fixed expense would be rent or a car payment. Entertainment and eating out would fall under variable. Check out your most recent credit card statements to help you out. If you plan on saving a set amount of money each month, include this under fixed expenses.

- Add up monthly income and expenses: Now add up how much money you bring in each month vs. how much you spend. If you discover your expenses are higher than income, it’s time to make a few changes.

- Make adjustments as necessary: Look for areas of overspending and focus on ways to trim your spending.

Tips on How To Save Money on Kids’ Clothes

Is your little one growing like a weed? Here’s a guide on clothing your child without breaking the bank.

There are tons of free monthly budget spreadsheets you can download to get started.

19 Frugal ideas to save money

Sometimes the key to saving money is making small changes in our daily habits and applying a DIY attitude like our grandparents or great-grandparents did.

1) Apply the 30-day rule

What is the 30-day rule? The 30-day rule applies to making big purchases on things you want. This makes you hit the pause button before you spend your hard-earned cash. To help you determine whether you really should make a large purchase, think about it for 30 days.

Take note of the item, how much it costs, and why you want it. Then wait for 30 days. Often after several weeks, you may discover that the allure of the item has worn off. Or perhaps you’ve changed your mind or found a better deal.

Why You Should Turn Down Your Hot Water Heater

Besides saving money, here’s a few reasons why you should consider turning down your hot water heater.

Frugal ideas to save on bills

2) Turn down the thermostat

An easy way to save money on your natural gas or heating bill is to lower your thermostat. While you don’t need to freeze, every degree lower adds to your savings. The easiest way to do this is to turn down the temperature at night while you sleep. Energy Saver estimates that you could save 5-15 percent on your annual heating bill if you set your thermostat lower by 10-15 degrees for a period of 8 hours.

3) Turn down your hot water heater thermostat

When it comes to heating your water, there’s a magic number: it’s 120 degrees Fahrenheit (49 degrees Celsius). This is the recommended hot water heater temperature according to the U.S. Department of Energy (DOE). By default, most thermostats are set to 140 degrees Fahrenheit (60 degrees Celsius). The DOE estimates that for every 10 degree reduction, you can save between 3-5 percent on your water heating costs.

4) Cancel unused memberships or subscriptions

Ditch the memberships or subscriptions that no longer serve you. That gym that you frequent less than once a month, or that subscription box that comes with stuff you don’t really want are good (and painless) places to start.

5) Fix leaky faucets

Not only are leaky faucets a waste of perfectly good water, the drips quickly add up. It’s estimated that you waste 10 liters or 2 gallons of water for one faucet which drips 30 times/minute. Check out the U.S. Geological Survey’s drip calculator.

6) Collect rainwater

Using less water is as simple as collecting free rainwater. Use your rainwater to water your flowers and garden.

7) Take showers over baths

Save baths for rare occasions (once a week or less) and take shorter showers. Showering uses less water. To fill the average bathtub, it takes about 106 gallons (400 liters) of water. On the other hand, showers use about 2.5 gallons (9.5 liters) a minute. If you take shorter showers, you’ll save money.

Creative Ways To Recycle and Repurpose Old Socks

Don’t toss those old socks! From practical to crafty, here’s a roundup of ways to use old socks around the house.

8) Use cold water for laundry

The only time you really need to use hot water for laundry is if you have an exceptionally dirty load. Otherwise, use cold water instead. Energy Star estimates that heating water for your washing machine uses up 90 percent of the energy required to operate the machine.

9) Air dry your clothes when possible

Use less energy and air dry your laundry when you can. Fresh air and sunshine is the best way to naturally dry your clothes. If this isn’t possible, try line drying your clothes over the bathtub or shower.

10) Do simple household repairs yourself

There are so many online tutorials and posts about fixing common household problems from leaky toilets to drafty windows. If you have a bit of know-how, you’ll save money and learn something new along the way.

“Without frugality none can be rich, and with it very few would be poor.”

—Samuel Johnson

Frugal ideas to save money on food

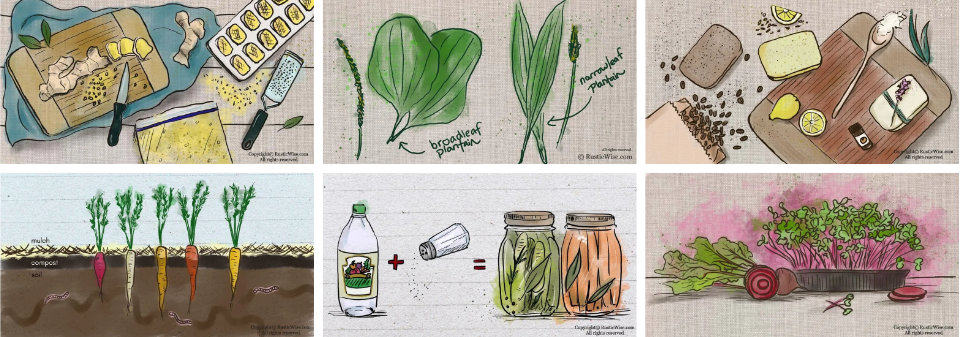

11) Start your own garden

You don’t need a ton of space to start your own garden. You can start a container garden if you’re short on space. The important thing is to grow what you like to eat. There’s no point in growing squash if your family hates it.

While there’s a small upfront cost to gardening (soil, seeds, and basic supplies) you tend to save money on food.

The National Gardening Association lays out a 20-foot-by-30-foot production garden with a variety of veggies including spinach, peppers, cucumbers, and cabbages, amongst others. Based on their pricing estimates, you would spend roughly $70 to plant the seeds that could yield 350 pounds of vegetables. If you purchased the same amount of food at the grocery store, you’d spend over $600.

How to Use Old Wax Melts and Candles

If you’re creative, you can find ways to reuse almost everything, including old wax candles.

One important factor to consider when planning your garden is to plant high-volume producing vegetables. A few good examples include: berries, green beans, herbs, lettuce, tomatoes, squash, and zucchini.

There are also other side benefits of gardening besides saving money including self-reliance, getting fresh air and sunshine, access to pesticide-free produce, and food security.

Credit: RusticWise.com

12) Grow your own sprouts and microgreens

If indoor gardening is more your speed, consider growing your own sprouts and microgreens. These tiny greens are packed with nutrients. They also don’t require much space and sprouts are ready to eat in a matter of days.

Sprouting seeds may cost a bit upfront, but you’ll save money compared to the hefty price tag of buying store-bought sprouts or microgreens. For example, a 1 kilogram pack of alfalfa sprout seeds costs around $30. Each tablespoon yields about 3-4 cups of sprouts. Compare this to a small 75 gram (roughly ⅔ cup) pack of alfalfa sprouts that can cost around $3.

13) Pack your own lunch

We all like to spend money on eating out. By packing your own lunch and treating yourself to eating out once a week or less, you’ll: a) save money; b) appreciate your restaurant meal more; and c) eat healthier.

14) Learn to can your own food

If you have a bountiful harvest from your own garden, preserve your food for the winter months by canning. Start with easy canning recipes such as pickles or applesauce.

15) Stock your pantry with cheap staples

Having a stocked pantry filled with affordable pantry staples allows you to plan ahead. You’ll be more likely to cook at home (which saves money), and less inclined to splurge on fast food. Affordable pantry staples include rice, beans, pasta, flour, potatoes, onions and baking essentials.

Recycle and repurpose

Making something new out of something old is something we can all get behind. Put your thinking cap on and get your creative juices flowing!

16) Learn to sew

You don’t need to be a great sewer, but it’s handy knowing a few basic stitches. If you regularly send your new pants to the tailor to get hemmed, you’ll save money by doing it yourself.

17) Save those socks

We all have pairs of old, holey, or mismatched socks. Save those socks and turn them into a dusting mitt, make a sock puppet, turn them into baby leg warmers. Check out more recycling old sock ideas.

18) Repurpose old wax candles

Old wax candle stumps or used wax melts have so many useful household applications. Use a wax candle to unstick a zipper. Rub a wax candle to help ease the sliding of a drawer. Save wax drippings to make a new candle.

19) Save money on kid’s clothes

The United States Department of Agriculture (USDA) estimates in their Expenditures on Children by Families report in 2017 that the average family spends $824 per child every year on clothing. There are so many easy ways to save money on kid’s clothes from buying secondhand, shopping at end-of-season for next year’s clothes, to buying timeless pieces.

Frugal ideas to save money: the takeaway

Frugality is a mindset, and way of living. Being less wasteful with money and the possessions you already have is just plain smart. By applying a few principles of frugality, you’ll save money, be less wasteful, and become more resourceful. What other ways can you apply frugality to your daily life?

👉 If you like this post, see other Frugal Ideas To Save Money. 💰

Would you like more timeless tips via email?

Fun tips to help you live an independent, self-sustaining lifestyle. Opt-out at any time.

References:

- Sherk, Sandra (19 July 2018). “How Did People Get By Before Credit Cards?“, Credit Canada. Accessed February 2021.

- Vohwinkle, Jeremy (06 October 2020). “How to Make a Personal Budget in 6 Easy Steps,” The Balance. Accessed February 2021.

- Energy Saver, Program Your Thermostat for Fall and Winter Savings, https://www.energy.gov/energysaver/articles/program-your-thermostat-fall-and-winter-savings. Accessed February 2021.

- U.S. Geological Survey, Water Science Activities, Drip Calculator: How much water does a leaking faucet waste? https://water.usgs.gov/edu/activity-drip.html. Accessed February 2021.

- Energy Star, Laundry Best Practices, https://www.energystar.gov/products/laundry_best_practices#:~:text=Water%20heating%20consumes%20about%2090,to%20operate%20a%20clothes%20washer. Accessed February 2021.

- The National Gardening Association, Edible Landscaping – Get Healthy and Save Money by Food Gardening, https://garden.org/learn/articles/view/4001/. Accessed February 2021.

Author: Theresa Tesolin

Theresa is co-founder of RusticWise. She helps people unleash their inner DIY spirit by encouraging them to get dirty and make or grow something from scratch.